Retirement Planning Advice

At This is Money we know that retirement planning is a concern for many of our readers, so we've partnered with expert financial planners, Flying Colours Advice, to help you plan for the retirement you want.

Retirement planning advice: why it’s worth paying for

What do you want from your retirement? Different people will have different answers to that question, depending on how they see themselves enjoying their pension years.

For some travel and adventure will be on the agenda, for others the opportunity to spend more time with friends and family closer to home is important.

But whatever their vision for their retirement, an ambition shared by the vast majority is financial security.

What is financial planning?

You may have a healthy pension pot, but creating a financial plan to make it last, deciding where to invest to make the most of it, and getting important tax considerations right, can be a daunting prospect.

This is where working with a financial adviser to achieve your retirement goals can really pay off.

Whether you are saving hard to build up your pension pot, nearing retirement and wondering what you can do to ensure you have enough, or at retirement and want help working out how to generate an income for the rest of your life, seeking professional help is a wise move.

And while you will need to pay for retirement advice, studies show that those who do see its lifetime value far outweigh the initial cost.

Don’t waste your retirement on regrets!

According to Standard Life’s report: Retirement Voice 2023:

41%

of retired men

44%

of retired women

say they wish they’d sought advice or guidance to plan for their retirement.

39%

worry about whether they’ve made the right choices about how they accessed their pension savings.

Less than

4 in 10

people think they’re saving enough for retirement, and 55% are worried that their pension savings won’t last throughout their retirement.

92%

of people

say that a guaranteed income in retirement is important to them, but at the same time, 89% want to be able to access their savings flexibly. Keeping a balance between the two is very tricky, especially if you plan to have money left at the end of your life to pass on.

We explain below how retirement planning advice can help you below, but first take our Retirement Ready Quiz.

Are you retirement ready?

How ready are your finances for retirement? Have a go at this simple online quiz to find out. It’s free and takes just five minutes. You’ll receive a bespoke score, along with tips for how you can improve it.

The value of working with a financial adviser for retirement planning

For many people value in retirement planning can be found in:

- Reducing costs

- Saving tax

- Saving time

- Bespoke advice on highly technical areas around retirement finances, such as using tax allowances, maximising alternative sources of income, long-term care planning and intergenerational planning

- Peace of mind that you’re on track to achieve your retirement goals

The proof that retirement planning is worth it

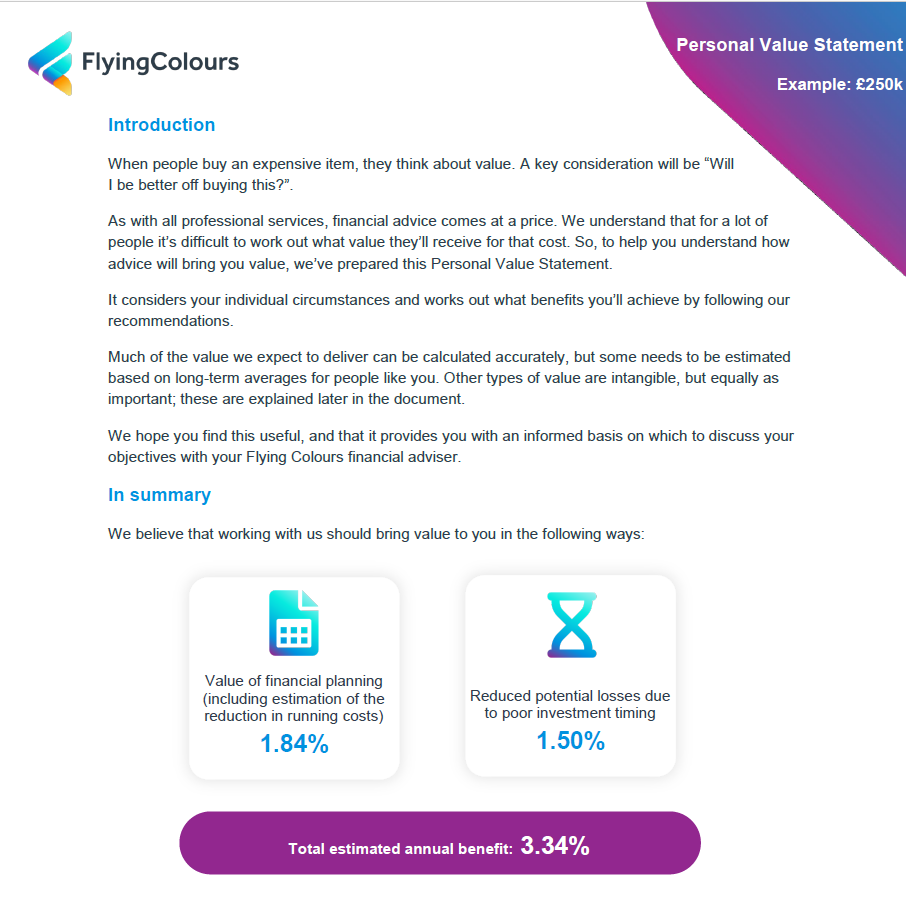

At Flying Colours Advice, we have a fresh approach to proving our worth. This means that when we present your financial plan, we’ll also provide you with a Personal Value Statement (PVS).

In it, we’ll demonstrate our value in the following ways:

- How we can help you achieve your financial goals

- If and where we can reduce costs

- Where we can save you tax

- How an appropriate and managed risk profile can lead to better outcomes

Although it’s not possible for us to provide you with a Personal Value Statement until after we’ve researched your finances and made our recommendations, you can see an example here:

Chris has provided peace of mind enabling us to now retire early. He has taken the time to get to know and understand us, helping us to develop and adapt our strategy. We have an open and transparent relationship with him which builds trust. He is personable and tailors solutions to our needs.

I’ve been absolutely delighted with the advice and support I’ve received from Maxine Clarke. She took the time to understand my goals, explained my options clearly, and helped structure my retirement plans. I now feel fully informed, supported, and confident about my financial future.

Luca encouraged me to take a step back and look at the bigger picture – how much risk am I prepared to take, how much income do I really need for my day‑to‑day expenditures, what are my plans for retirement. Luca worked through all the steps of the process at my pace, patiently explaining all the jargon as we progressed.

Chris took the time to understand our goals, provided clear explanations of approaches and a thoughtful, well-structured follow up note. Chris' approachable nature and attention to detail was first class. Following our interactions we now have a much clearer understanding of the relevant aspects to our estate planning.

Liv patiently understood our circumstances and conducted the due diligence required to provide very transparent and exceptionally professional advice. He struck a great balance on long‑term investments, pensions, insurance and retirement. I found Liv very knowledgeable, confident, and personable.

Tom expertly guided me through the complex and time-consuming process associated with consolidating several company pensions. Tom has also provided advice on a number of other financial benefits I was previously unaware of.

Ross gave me a lot of very useful information. He explains everything in a clear and concise way and doesn’t fill your head with jargon you may not understand. He keeps it plain and simple. Ross helped me understand how I could claim back overpaid tax and money I had been paying for a service with a previous pension adviser that shouldn’t have been charged.

From the initial meeting, George was able to understand my concerns and present options for how I could move forward. At no point did I feel any pressure, and I felt from the outset that I wanted to establish a long‑term relationship with George.

Russ guided me through the process of assessing current and future demands on my finances and the selection of appropriate pension investments. Throughout the process Russ has been very patient and explained clearly different options with their risk/benefit profiles. I have found his manner very supportive.

I had several meetings with Freddie to discuss my medium‑ to long‑term goals, my appetite for risk, the kind of retirement I would like and at what age. We then walked through my current finances in detail, and Freddie presented the gap between where I am now and where I would like to be, and proposed some changes that could help me achieve my goals in future.

Liviu has provided us with invaluable help regarding our pensions and how to best plan for our retirement. He has always made time to explain our options and fully answer any concerns we had. He has always gone the extra mile to ensure we were comfortable with the decisions we made and was endlessly patient.

I cannot tell you how much it has meant to have Russell Bruce’s advice. I no longer worry that I’m not doing enough to feel financially secure and confident about the future, and that has made a huge difference for me. I find him very easy to talk to; he has a lovely professional, friendly manner. I’ve already recommended him to a family member.

I’ve been a client of FC for almost 10 years and it’s proved to be one of the best financial decisions I’ve made. The advice, care and detail given to me has always been fantastic both from my advisor Billy and the whole FC team. I have recommended their services multiple times before and wouldn’t hesitate again! A brilliant company!

I asked Billy outright, if Flying Colours would make us that fee back in the first 12 months of managing our pensions. He told me it would and I’m happy to say he was right. We’ve got to know him really well and we completely trust the advice he gives us; advice which, over the years, has covered way more than just our pension.

Got questions?

Use our LiveChat tool to speak directly to one of our Client Relationship team members.

How much does it cost?

Like most financial advisers, our advice fees are based on a percentage of the assets that we advise you on. This is broken down into an initial fee and then, for most clients, an ongoing annual fee.

We can’t provide a price list, because everyone’s finances are different and the cost depends on how complicated your requirements are and the work involved in helping you.

What Flying Colours Advice can promise is that the initial fee is agreed with you from the outset – and we won’t charge you until you have agreed on the work you’d like us to do.

Find out how you could benefit from financial planning

To book a free, no-obligation consultation with an independent financial adviser, book a call with our Client Relationship team.

In partnership with

In partnership with