In light of recent events taking place in the Red Sea, our Investment Team has put together the following analysis to explain what is happening and the potential impact of these events on your investments.

The importance of shipping in the global economy

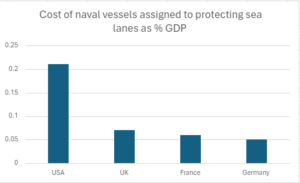

With approximately 90% of global traded goods relying on shipping and almost all essential commodities depending on maritime transport, the stability of sea routes is pivotal for international trade. Historically, both the United Kingdom and the United States have played a significant role as protectors of sea lanes, investing substantial resources in safeguarding global shipping routes.

Source: Center for Global Development

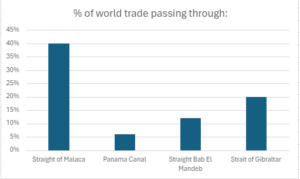

The global shipping system revolves around crucial points linking North America, Europe and Asia, passing through mandatory narrow passages known as “choke points”. For example, to go from Asia to Europe, one of the choke points is the straight of Bab El Mandeb (indicated on the map below in red).

Map of maritime shipping routes and strategic locations

Source: Port Economics, Management and Policy

Four of these choke points facilitate the transportation of nearly 80% of all global trade. Protecting these choke points is therefore fundamental for the smooth functioning of the world economy. But in the last few weeks, one of them, the straight of Bab El Mandeb, has become a hot spot.

Source: ISM world 2022

Identifying the key players and locations

Since December 2023, the Strait of Bab El Mandeb, a narrow channel connecting the Mediterranean to the Indian Ocean via the Red Sea and the Suez Canal, has become a focal point. A Yemeni armed group, the Houthi rebels, aligned with Iran, has been targeting container ships in this region.

Controlling a significant part of Yemen, including the Red Sea coast, the Houthis, part of the “axis of resistance,” a coalition against Israel and the West, have escalated attacks on commercial vessels following the Gaza conflict. These acts of aggression have subsequently led to the US and UK conducting bombing raids on strategic Houthis positions, which has served to escalate the tensions.

Equipped with Iranian-made weapons, including drones, missiles, and speedboats, the Houthi attacks have caused minimal damage but led to a twenty-fold increase in insurance premiums.

As a result, an increasing number of ships are constrained by their owners to take a longer route around the Cape of Good Hope, adding ten days to the average journey from Asia to Europe, which has led to an increase in freight costs by approximately $1 million per journey.

Impacts on global trade

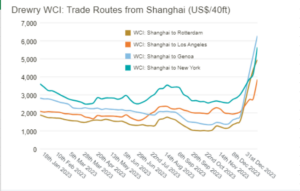

The Suez Canal’s traffic has dwindled since mid-January, with a 50% decrease compared to the 2023 average, as more ships opt for the longer route to avoid the Red Sea.

This shift in maritime routes has resulted in a general increase in freight costs, even for routes that don’t traverse the Suez Canal. The longer a ship spends at sea, the less available it is for transporting other goods, posing a challenge to the recovery of global trade.

Source: Drewry Supply chain advisors January 2024

Impacts on energy supplies

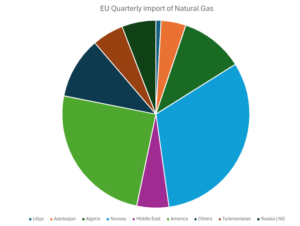

While there is concern about the impact on natural gas availability in Europe from the Middle East, the effect is expected to be limited. Only 6% of European gas is imported from the Middle East and any increase in cost is projected to be marginal, avoiding a repeat of the energy shock experienced in 2022.

Conclusion

While acknowledging the disruptions caused by the recent events in maritime security, we remain optimistic about the overall impact on the global economy. We do not anticipate an overwhelmingly negative outcome. Instead, we perceive the potential impact as a minor delay in a further reduction in inflation. Historically, the world has demonstrated resilience in adapting to fluctuations in shipping costs, and we believe that the current situation will prove to be no exception.

Our evaluation of this issue points towards a moderate impact that can be absorbed by the global economic system. The temporary shift in shipping routes, though influencing freight costs, is unlikely to result in an enduring setback. Previous instances have shown the world’s ability to navigate and overcome challenges in the shipping industry.

Additionally, our outlook is tempered by the belief that the current situation is not poised to escalate into a widespread armed conflict. We observe a lack of regional appetite for such a scenario, contributing to our confidence in the containment of the issue.

In summary, while acknowledging the challenges posed by the recent developments, we maintain a measured optimism about the world’s ability to weather these disruptions. The impact is expected to be manageable, and we remain hopeful for a swift return to more normalised shipping conditions.