The way that you manage your wealth could have a significant effect on your overall happiness and wellbeing. If you’re in control of your finances, you could improve your quality of life and save for the future, hopefully achieving important goals. By understanding the personality traits and behaviour patterns that govern your relationship with your wealth, you may be able to manage your finances more effectively. This article will help you understand your financial personality colour and recognise how psychological factors influence your financial decisions is crucial, especially when considering issues like money dysmorphia and financial impact.

This awareness can help you identify any detrimental beliefs or habits that may be hindering your financial progress. By addressing these challenges, you can cultivate a healthier relationship with money and create a more sustainable financial future.

A psychological framework known as “personality colours” could help you achieve this.

TL;DR – Managing Your Money with Your “Personality Colour”

- Understanding your personality colour (Red, Blue, Yellow, or Green) helps uncover your natural money behaviours and habits.

- Reds are goal‑driven and confident but may need stricter budgeting to avoid impulsive spending.

- Blues are cautious and detail‑oriented but may overthink finances and delay key decisions like retirement.

- Yellows are optimistic and idealistic but may avoid serious conversations like planning for illness, death or protection needs.

- Greens value stability and routine so they’re likely to save consistently and find it easy to work with advisers.

Knowing your colour can reveal both strengths and blind spots guiding you toward financial habits that suit your style. Read on to learn more.

Find Your Financial Personality Colour & Get Tailored Advice

Have you ever wondered why you spend impulsively while your partner meticulously plans every penny? Understanding your unique financial personality can be the key to unlocking better money management habits. Our simple, colour-based test helps you identify your core traits and provides personalised advice. In his book Surrounded by Idiots, psychologist Thomas Erikson identified four distinct personality types that most people fit in to. His hope was that understanding your own, and other people’s behaviour would help you work together more effectively and improve relationships.

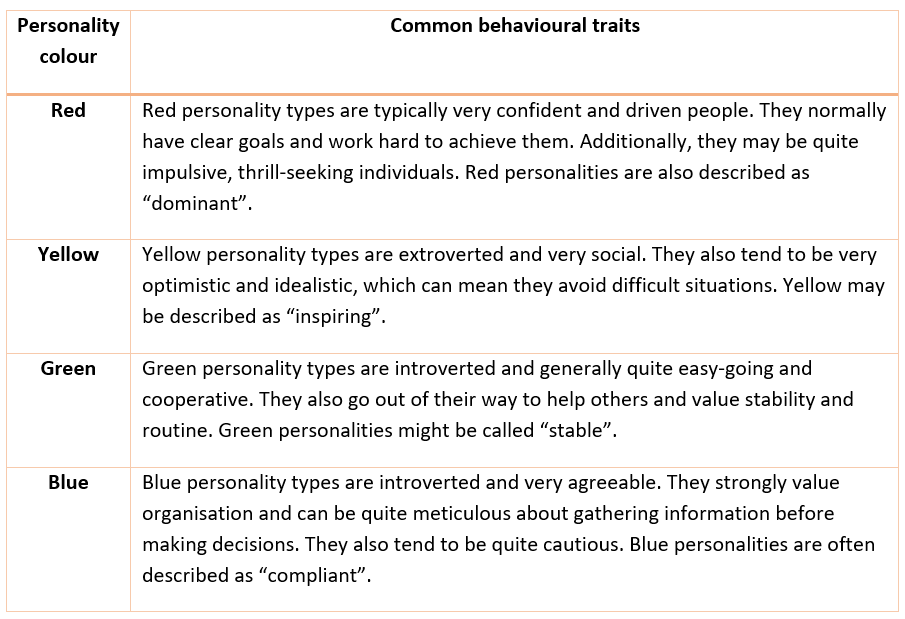

Erikson called these categories “personality colours”. The following table demonstrates the general characteristics associated with each colour:

These categories are not rigid, and many people exhibit a combination of traits from different colours. However, you may fit into one colour more than the others. You can take an online quiz to determine your personality colour.

So how might understanding your colour personality help you manage your finances?

Your Financial Personality Colour: What Does It Mean for Your Personal Finances?

Once you’ve taken the quiz, you’ll be assigned a colour. Each colour represents a different financial personality, with its own strengths and weaknesses.

Red Personality: The Impulsive Spender

If you fit into the red category, you’re likely to be very goal-oriented, which is a positive when it comes to financial planning. For example, you may find it easier to prepare for retirement if you have a clear picture of what you want your lifestyle to look like.

You might also be more confident than others about managing your wealth, so you’re less likely to experience stress. Additionally, increased confidence could mean that you’re more inclined to negotiate with providers about bills, check your bank accounts regularly, or make ambitious plans.

All this could mean that you have more control over your wealth and you’re better able to work towards your goals. However, red personalities may also be impulsive and more open to risk-taking, which could mean that you’re prone to poor spending habits. For instance, a study from the University of Lincoln found that confident personality types tend to budget less and use credit more often than their reserved peers.

So, if you fit into this personality type, you may benefit from setting clear budgets to manage your spending. This could mean you’re able to save more for the future and achieve the goals that are so important to you.

- Traits: You’re a natural risk-taker, full of passion and drive. You love the thrill of a new purchase and often make spontaneous decisions without much thought.

- The financial challenge: Your impulsiveness can lead to overspending and a lack of long-term planning.

You may struggle to stick to a budget, and your finances can feel chaotic. - Our advice is to take control, you need to learn to pause before you spend. Create a simple budget and use tools like a spending tracker to gain a clear picture of where your money is going.

Setting up automatic transfers to a savings account can also help you build a buffer without even thinking about it.

Red personalities may be more driven when managing their finances but could also lack discipline

Three life-changing financial lessons to teach your loved ones during Talk Money Week

Blue Personality: The Organised Planner

Blue personalities are usually very cautious, which can be a positive but may also create hurdles in financial planning.

For instance, if you’re overly concerned about not being able to fund your lifestyle, despite reaching your savings goal, you might continually delay your retirement. Yet, if you wait too long, you might be more likely to experience health issues because you’re older. This could make it harder to achieve certain goals such as travelling, spending more time with your family, or indulging in your favourite hobbies.

This is an example of how being too cautious could affect your ability to achieve your goals in life. If you’re a blue personality, your caution may benefit you in some situations as it prevents you from making poor financial decisions. However, it’s important that you don’t lose sight of your long-term goals because you’re over-analysing your finances.

- Traits: You are a highly organised and detail-oriented person who loves structure and security. You’re great at saving money and keeping track of your finances.

- The financial challenge: Your cautious nature means you might be risk-averse when it comes to investing, potentially missing out on opportunities for growth.

You may also be so focused on saving that you forget to enjoy the fruits of your labour. - Our advice is to challenge yourself to take calculated risks. Consider speaking with a professional financial adviser about diversifying your investment portfolio. Remember, a balance between saving and spending is key for a truly healthy financial life.

Blue personalities could be over-cautious and may struggle to focus on goals

Yellow Personality: The Optimistic Giver

Yellow personalities tend to be optimistic and idealistic about the world. While this positivity can be a desirable trait in relationships, it could also mean that you shy away from certain conversations about your wealth because you see them as negative.

For instance, discussing what happens after you pass away or considering the possibility that you might become seriously ill isn’t particularly optimistic. Also, as an idealist, you might believe that difficult situations are unlikely to affect you.

Unfortunately, this could leave you and your family vulnerable because you haven’t considered important protection such as life insurance or income protection. Your family could experience issues when you pass away too because you don’t have a clear estate plan in place.

That’s why, if you’re a yellow personality, you may need to resist your natural tendency to only consider the positives, so you can prepare yourself and your loved ones for the worst.

- Traits: You are an eternal optimist who loves to help others. You are generous with your time and money and are often seen as the life and soul of the party.

- The financial challenge: Your generosity can be a double-edged sword, as you may put others’ needs before your own financial security. Your optimistic outlook might also lead to unrealistic expectations about your future wealth.

- Our advice is to consider that while your generosity is a wonderful quality, it’s important to build a strong financial foundation for yourself. Set clear financial boundaries and remember that it’s okay to say no sometimes. Create a budget that includes a dedicated “giving” category, so you can still share your wealth without compromising your own financial stability.

Yellow personalities could shy away from “negative” conversations about their wealth.

Green Personality: The Cautious Investor

If you fit into the green personality category, you may find financial management feels quite natural to you. This is because you’re likely to value stability, meaning you see the benefits of budgeting to achieve security now and in the future.

Additionally, if you’re very routine-driven, you may find it quite easy to establish positive habits such as saving and investing for the future. Green personalities are also very cooperative, meaning you may work well with a professional financial adviser. This valuable support could make it easier for you to work towards your financial goals.

- Traits: You are thoughtful and highly value security. Your cautious approach means you are unlikely to make risky financial decisions.

- The financial challenge: While your risk-averse nature is a strength, it can hold you back from growing your wealth. You may be missing out on valuable investment opportunities.

- Our advice is to start by researching low-risk investment options and consider consulting an expert. This could include a link to our

retirement savings quiz

Green personalities may find financial planning comes naturally to them.

Why it’s important to look beyond returns when creating your investment portfolio

Get in touch

Whatever your personality colour, we can work with you to understand your relationship to your wealth and establish positive financial behaviours.

Email hello@fcadvice.co.uk or call 0333 241 9900 to learn how we could help you work towards your goals.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Review our other resources

Why Cash Might Not Be King in a World of High Inflation

10 Unique Destinations to Add to Your Bucket List