Tensions in the Middle East have sharply escalated over the last 3 days following a major Israeli military operation that has drawn global attention and concern.

What Happened

On Friday, June 13th, a significant conflict escalation unfolded in the Middle East. This escalation introduces heightened geopolitical risk with far-reaching implications for global markets.

Implications

Short-term impact

The market response was swift. Global oil prices surged sharply, reflecting growing fears of supply disruptions in the region. Equity markets also reacted, with the Dow Jones Industrial Average falling over 750 points and airline stocks taking a hit due to rising fuel costs and travel uncertainty.

- Gold: As investors sought safe-haven assets, gold prices spiked sharply. Spot gold (XAU/USD) surged past $3,400, reaching a five-week high of $3,446 before settling around $3,422—up more than 1.4%.

- U.S. Treasury Yields: Initially, yields fell slightly due to a flight to safety, with the 10-year yield dipping to 4.3%. However, as markets digested the inflationary implications of rising oil prices, yields rebounded later in the day, with the 10-year yield climbing to 4.413%—a net rise of over 0.05%.

This dual movement reflects the market’s balancing act between risk aversion and inflation expectations, especially as investors anticipate the Federal Reserve’s next policy steps.

Long-Term Potential Consequences

The long-term impact of this conflict escalation remains uncertain and will depend on several evolving factors.

Key variables to monitor include:

- U.S. diplomatic and military posture in the region,

- Reactions from other regional powers (e.g., Saudi Arabia, Turkey, Russia),

- Global energy market stability, and

- Potential for asymmetric retaliation or proxy conflicts.

Summary of Regional Impact

- US: Sharp decline led by travel and tech; defence stocks gained.

- Europe ex-UK: Moderate drop; energy and defence outperformed.

- UK: Resilient due to oil majors; limited downside.

- Emerging Markets: Hit hardest; currency and equity pressure.

- Japan: Declined modestly; yen strength cushioned losses.

Additional Market Reactions

- Bond Yields: U.S. 10-year yield rose by +5 bps to 4.41%

- Oil: Brent crude surged +7% to $74.32

- Gold: Rose +1.4% to $3,422

Potential supply chain disruptions

The Strait of Hormuz is a vital maritime chokepoint through which roughly 20% of global oil supply passes, making it a strategic vulnerability in times of conflict. Iran has previously threatened to close the strait in response to sanctions or military pressure, and current tensions raise the risk of such a move being reconsidered. A closure would likely trigger a sharp spike in oil prices, disrupt global shipping, and escalate geopolitical instability.

Opportunities

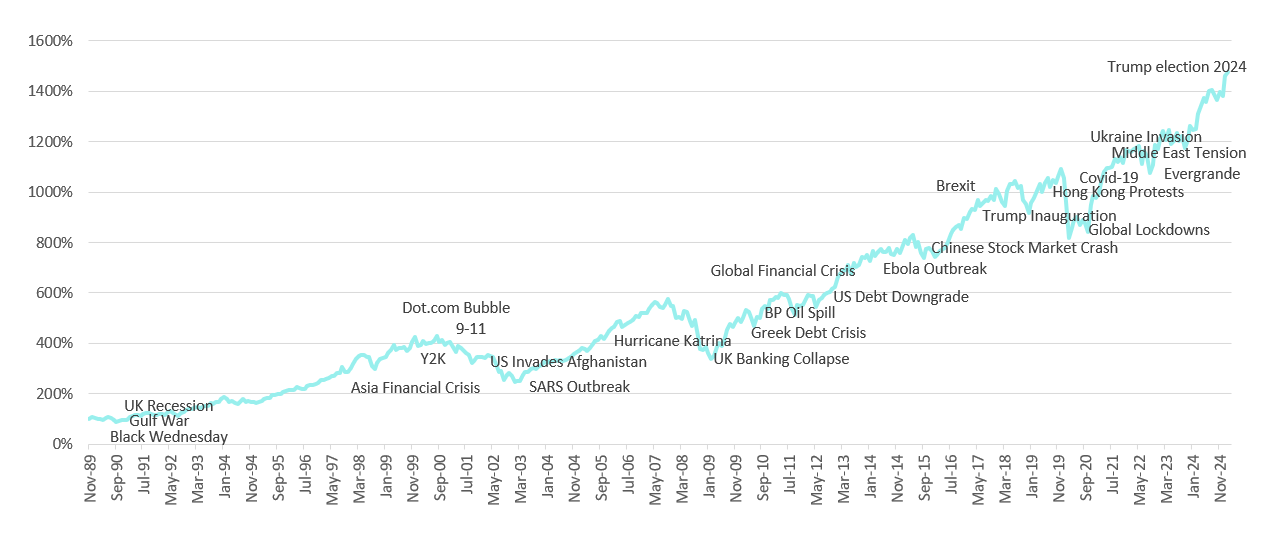

It is notoriously difficult to predict events and their consequences, although a lack of certainty in global markets is a source of worry. The chart shows that while multiple crises have occurred over the past 30 years, they are temporary.

Source: Flying Colours, Refinitiv, data as of February 2025

Summary

While the situation remains fluid, history shows that markets tend to recover from geopolitical shocks over time. Maintaining a long-term investment perspective is crucial amid short-term volatility.

Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term (minimum of 5 years) and should fit in with your overall risk profile and financial circumstances.